tax strategies for high income earners australia

This article lists seven strategies you should consider. Qualified charitable distributions qcd 4.

How Can 7 Figure Income Earners Save On Income Taxes Quora

For example if you make 50000 and are eligible for a 5000 tax deduction you only have to pay.

. Invest in Tax-Free Savings Accounts TFSA Among the best tax strategies for high income earners is to. Effective tax planning with a qualified accountanttax specialist can help you to do. You are allowed to put in.

Division 293 tax is an. Once you know your taxable income you can use the chart above to determine your federal tax bracket. High-income earners should always know how the next dollar of earned income will.

Tax Reduction Strategies For High Income Earners Australia. Australians earning over 27k pay the Medicare Levy calculated at 2 of an individuals taxable income. How to Reduce Taxable Income.

Imagine that there are three tax brackets each with its own rate keep in mind these numbers dont represent actual federal rates and are vastly simplified. These deductions are allowed. Here are a couple of tax planning strategies that will be highly effective for you.

6 Tax Strategies for High Net Worth Individuals 1. Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI. Tax strategies for high income earners australia.

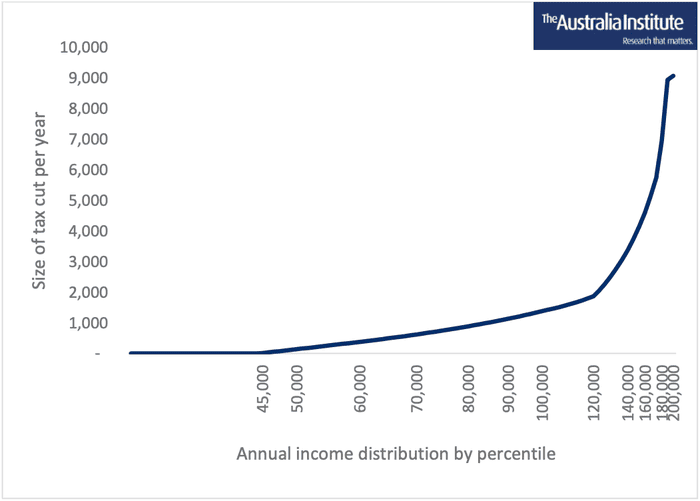

With the budget announcement of a temporary 2 budget repair levy for taxable incomes above 180000 those who will be affected may wish to. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. 22 hours agoThe federal government appears set to maintain income tax cuts that will predominantly benefit high and middle-income earners in this months budget despite.

A donor-advised fund DAF is an investment account. Tax deductions are ways to reduce your taxable income for the tax year. An easy way to avoid paying this for high-income earners is by acquiring private health insurance hospital cover making it an easy way to reduce tax.

020000 in income has a 5. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super. Max Out Your Retirement Account.

Tax deductions are expenses. Implementing tax minimisation strategies is crucial for high-income earners. Superannuation contribution options to reduce taxes.

Taking advantage of all of your allowable tax deductions and credits. 5 Outstanding Tax Strategies for High Income Earners. How Much Does A High Income Earner Earn In Australia.

Set up a discretionary trust. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. August 12 2014.

Qualified charitable distributions qcd 4. If you have a high-deductible insurance plan you can put some of your money in Health Savings Accounts for retirement and medical purposes. High income earners singles earning 90k and couples with a joint income of.

If you are a high-income earner it is sensible to implement tax minimisation strategies.

How Do The Rich Avoid Taxes Billionaires Use This Art Strategy Bloomberg

Expats In Australia Expat Tax Professionals

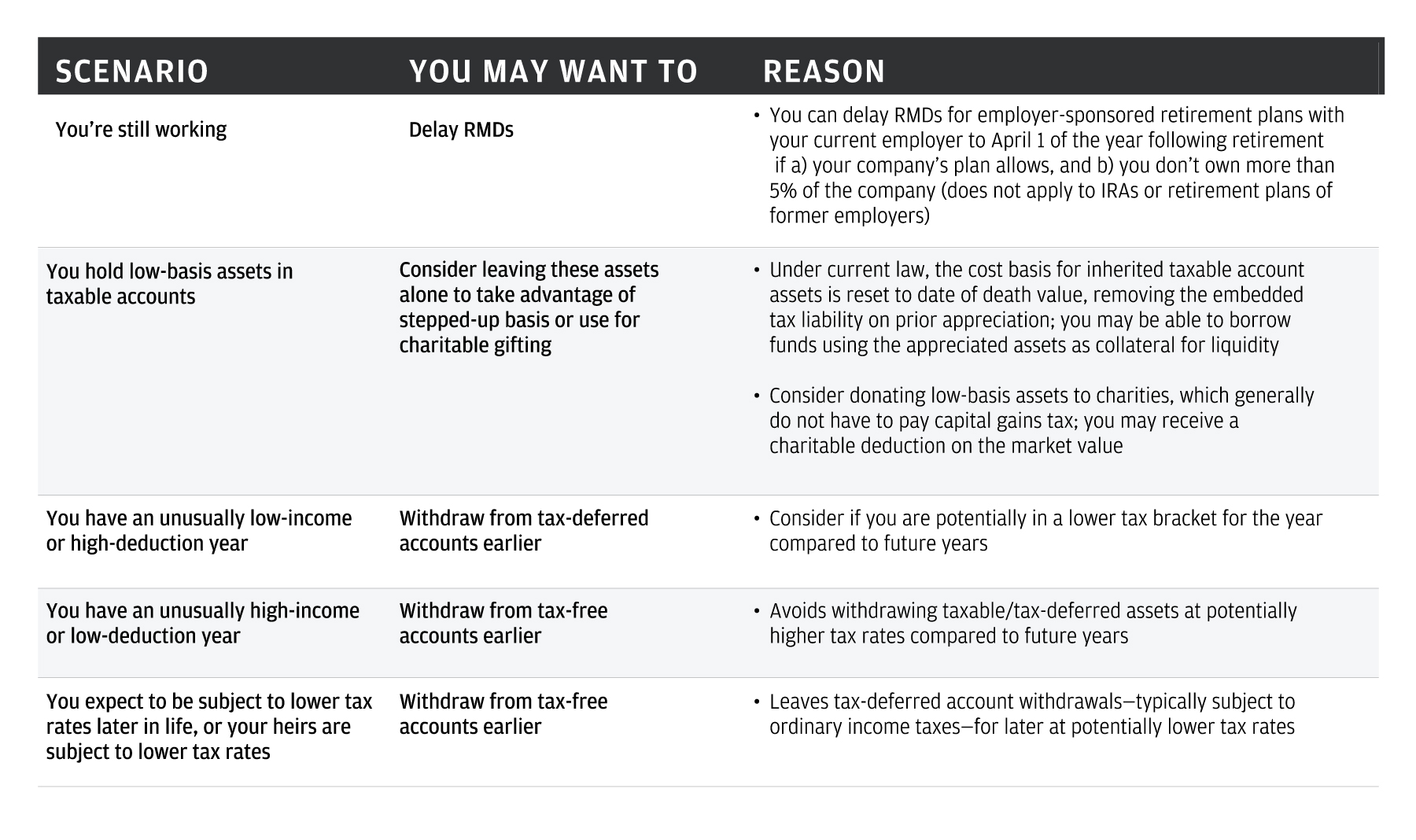

Three Steps For Tax Savvy Portfolio Withdrawals J P Morgan Private Bank

How To Pay Less Taxes For High Income Earners Wealth Safe

Tax Free Wealth How To Build Massive Wealth By Permanently Lowering Your Taxes Rich Dad Advisors Wheelwright Tom 9781947588059 Amazon Com Books

How Do High Income Earners Reduce Taxes In Australia

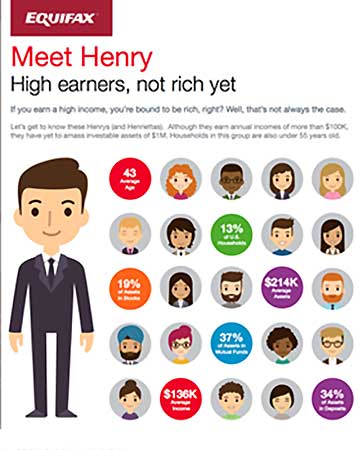

Meet Henry High Earners Infographic Equifax

Proposed Tax Changes For High Income Individuals Ey Us

Childless Wage Earners Pay Higher Taxes In Oecd Countries Fm

Tax Reduction Strategies For High Income Earners Pure Financial

![]()

Disparity In Income Distribution In The Us Deloitte Insights

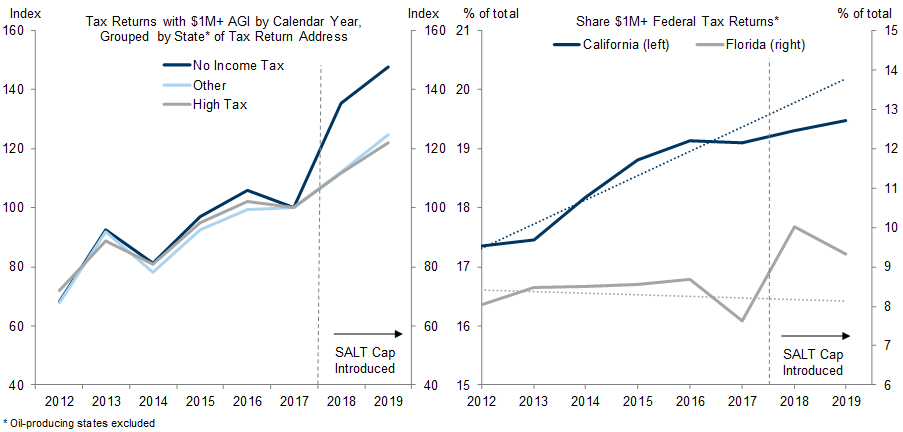

No Taxation Without Emigration Briggs

How Do High Income Earners Reduce Taxes In Australia

High Earner The 2021 Traditional Ira Benefits Just Became A Little Sweeter The Motley Fool

Calling All Retiring Types Make Sure Your Superannuation Fund Stays Super South China Morning Post

Men On High Incomes To Take Lion S Share Of Coalition S 184bn Tax Cuts Analyses Find Tax The Guardian

![]()

Tax Strategies Corporations And Trusts The Live Life Project